Mandarin Oriental has announced plans for its second Greek property and the first in the country’s capital Athens.

The 123-room hotel will be situated within The Ellinikon – an $8 billion urban regeneration project on the site of the city’s former Hellenikon International airport. The shoreline Mandarin Oriental, Athens is scheduled to open in 2027, and will also offer 17 branded Residences, including waterfront villas and apartments.

Source: https://www.businesstraveller.com/business-travel/2023/05/26/mandarin-oriental-to-open-athens-property/

- We cover themed resort developments worldwide!

- Resort Construction. Nothing else.

- Bookmark resortX. Stay up to date!

- Click here to find resortX on LinkedIn

- Click here to see our founder's personal travel map

Send your construction pics to content_at_themeparxdotcom

Miscellaneous resort projects

Miscellaneous resort projects

Views: 186,981

Subscribe

Post an Update

Posts 71 - 80 of 333

Local Name:

Budget:

Announced:

Construction Start:

Opening:

Location:

Area:

Developer:

Operator:

Consultants:

Designers:

Contractors:

Ride Suppliers:

Other Suppliers:

-

resortX Top Investigator

resortX Top Investigator

- Join Date

- Jul 2019

- Posts

- 1,114

-

resortX Top Investigator

resortX Top Investigator

- Join Date

- Jul 2019

- Posts

- 1,114

More Concrete Walls Added to Disney Vacation Club Tower at Polynesian Village Resort

Source: https://wdwnt.com/2023/05/photos-more-concrete-walls-added-to-disney-vacation-club-tower-at-polynesian-village-resort/

-

resortX Top Investigator

resortX Top Investigator

- Join Date

- Jul 2019

- Posts

- 1,114

PIXAR Place Hotel construction DVC NEW office & info + tower name Revealed. Disneyland Resort update

-

resortX Top Investigator

resortX Top Investigator

- Join Date

- Jul 2019

- Posts

- 1,114

Construction has begun on Everest Place, a development near Walt Disney World, featuring shopping, dining, and several hotels, including Nickelodeon Hotels & Resorts.

Everest Place will be a multi-use development with 783 condominiums, 793 hotel rooms, and 900 rental apartments, plus 20 acres of commercial and retail space and an additional 12 acres reserved for a recreational water park, all with easy access to Disney theme parks. The project also includes a park, a lake with a waterfront boardwalk, and multi-use and nature trails.

Source: https://attractionsmagazine.com/nickelodeon-hotels-and-resorts-returning-to-orlando/

-

resortX Top Investigator

resortX Top Investigator

- Join Date

- Jul 2019

- Posts

- 1,114

Source: https://www.nbcnewyork.com/news/local/nassau-county-approves-99-year-lease-for-las-vegas-sands-casino-around-nassau-coliseum/4357490/Plans to bring a casino to Long Island have taken a big step forward, but there's still a long way to go. The Nassau County Legislature voted 17-1 Monday night to to grant Las Vegas Sands a 99-year lease to develop the 72-acre area around the Nassau Coliseum in Uniondale. The $5-billion project will include a casino, hotel, entertainment venue and housing.

-

resortX Top Investigator

resortX Top Investigator

- Join Date

- Jul 2019

- Posts

- 1,114

AlUla‘s hospitality offering is expanding with the news of a new eco-resort AZULIK AlUla. With plans to open by 2027, the sustainability-focused property will have 76 luxury villas.

Source: https://www.hoteliermiddleeast.com/saudi-arabia/saudi-arabias-alula-reveals-new-eco-resort-azulik

-

resortX Top Investigator

resortX Top Investigator

- Join Date

- Jul 2019

- Posts

- 1,114

A potential Therme site for the US?

Global wellbeing organisation Therme Group US and Washington DC Mayor Muriel Bowser have signed a deal to work together toward identifying a site for a new Therme facility. Therme is expanding into the US and has identified the DC-Maryland-Virginia (DMV) region as the location for its flagship US facility. For the duration of this one-year exclusive rights agreement, Therme will only explore sites in the District and not seek to compete with the District against surrounding jurisdictions.

Source: https://www.attractionsmanagement.com/index.cfm?subID=0&pagetype=news&codeID=351294&dom=n&email=web&pub=AMe&date=

-

Guest

It's quite shocking that a resort with that kind of simple look costs a whopping $1 billion these days. The original Disneyland cost $17 million. That's what inflation does to your money!

-

resortX Top Investigator

resortX Top Investigator

- Join Date

- Jul 2019

- Posts

- 1,114

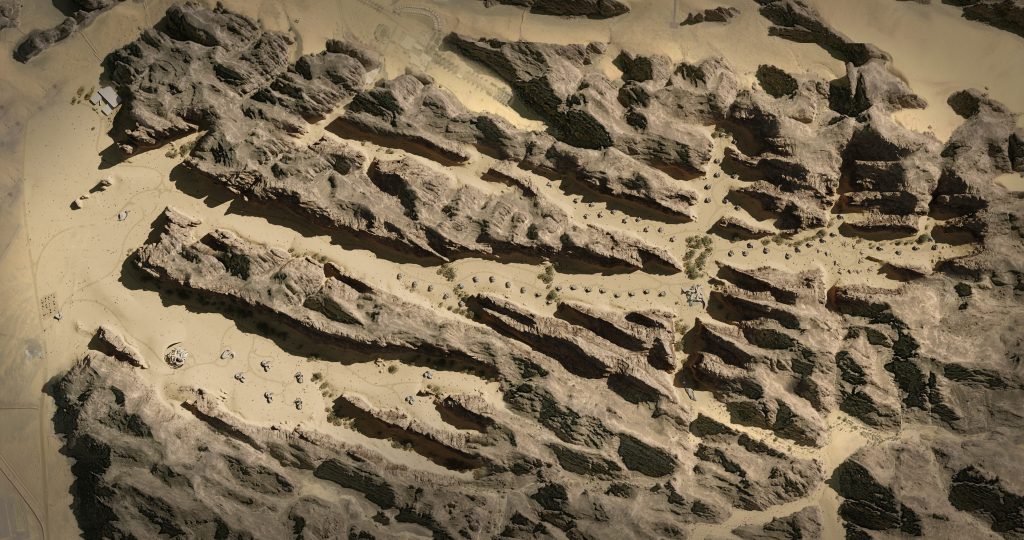

Aerial look at the $1 billion Evermore Orlando resort. Anchored by Conrad Hilton Orlando, at right. Notice the extremely large pool prepared for water recreation. Reservations available for stays beginning February 5, 2024.

Source: https://twitter.com/bioreconstruct/status/1657155609626542083

-

Administrator

Administrator

- Join Date

- May 2011

- Posts

- 269

Not an island for millionaires, but this is Dubai healthcare city – A floating island concept with its own underwater transportation system that is designed to provide state-of-the-art healthcare to the residents of the emirate

What catches the eye instantly is a core skyscraper that looks like it’s splitting from the center. This unique space spans an area of one million square meters. The first part is spread across 670,000 sq.m and houses educational activities. In contrast, the other 330,000 sq.m half is dedicated to functions such as the exhibition hall, research and development department, science and technology park, library, and exhibition area.

Source: https://luxurylaunches.com/other_stuff/dubai-healthcare-city.php

Reply

Reply